Q3 in Solana's DeFi universe was like a high-octane construction site, buzzing with ingenuity, experimentation, and a dash of organized chaos. From seasoned developers to enthusiastic community members, everyone has been rolling up their sleeves, laying down a myriad of foundational blocks for a skyscraper of financial innovation that we're all keen to inhabit.

This isn't just about piling one block on top of another; it's about meticulous architecture. The builders, be it developers or community contributors, have been working synergistically to ensure that every block adds unique value to the entire structure. The fruits of their labor? An ecosystem that's not only growing but evolving in exciting and unpredictable ways.

Thanks for reading FA2’s Substack! Subscribe for free to receive new posts and support my work.

Subscribed

To give you a sense of this foundational work, consider the following highlights:

TVL Growth: The Total Value Locked in Solana's DeFi shot up by 21%, scaling from $268.16M to a staggering $327.1M.

Daily Active Wallets: A consistent engagement level, bouncing between 230K and 350K daily active wallets.

Trading Volumes: Even excluding heavy-hitters like Zeta Markets and Phoenix, trading volumes have been swinging between $15M and $162M.

Beyond the numbers, several headline-grabbing events have also catalyzed the Solana ecosystem:

MakerDAOlaunch using Solana's Virtual Machine (SVM).

CNBC giving Solana the nod over Bitcoin Cash and Litecoin.

The much-anticipated return ofMaple Financeto Solana.

The splashy entrance of EUROemoney onto the Solana stage.

Taking a look into what protocols have built in Q3 & what we can expect in Q4.

Derivatives and Synthetic Assets

Lots of activity in the derivatives and synthetic assets sectors. Here are the details:

Zeta Markets

Q3 Recap:

New V2 Upgrade: Enhanced system architecture for performance improvements.

New User Interface: Simplified and user-friendly trading experience.

Portfolio Page: Real-time asset and trade tracking in one dashboard.

USDC Margined Perpetual Trading: Introduction of new USDC-based trading options.

On-Chain Order Books: NASDAQ On-chain speed

Q4 Forward Look:

Faster Trades: The team plans to speed up trade execution times.

New Incentives: Aiming to roll out rewards and incentives to attract and retain users.

Trade on Zeta: Zeta Markets

Follow Zeta: Twitter

Drift

Q3 Recap:

Weekly Active Users: Reached an all-time high of 1,800 on August 21.

TVL Growth: A 50% increase in Total Value Locked, now standing at $13.2M.

New Features:

Leveraged Swaps: Allowing users more trading options.

Drift Liquidity Provider (DLP): Over $7M in liquidity added to the platform.

Q4 Forward Look:

MetaMask Integration: For more accessible user onboarding and interaction.

Partnership with Circuit Vaults: To bring in additional liquidity.

These developments point toward a robust and expansive Q4, aiming to further elevate Drift’s utility and user base.

Trade on Drift: Drift Trade

Follow Drift: Twitter

Cypher

Q3 Recap:

TVL Growth: A 10x increase in Total Value Locked in less than three months

Security Exploit: The platform was hit by a security vulnerability, which has since become a focal point for improvement.

Q4 Forward Look:

Issue Resolution: Efforts are underway to address the security issues and regain user trust.

IDO: Planning to launch an IDO for the $CYPH token as part of the recovery and expansion strategy.

The upcoming IDO and ongoing security improvements aim to restore confidence and set the stage for future growth.

Trade on Cypher: Cypher Trade

Follow Cypher: Twitter

Liquid Staking Tokens ( LSTs )

The integration and rise of LSTs in Crypto also landed in Solana with token launches, deeper integrations and more use cases. In Q3, there were token launches, key base innovations to further expand the use cases of LSTs.

Sanctum

Q3 Recap:

Reserve Pool: Sanctum has built up a reserve of over 200,000 SOL.

Partnerships: Discussions are underway with NFT marketplaces regarding the use of LSTs.

Q4 Forward Look:

Upcoming Features: Sanctum has not released specific details but indicates that new functionalities are in the pipeline.

Sanctum has made some progress in Q3, particularly in amassing a significant reserve pool and initiating partnership talks. The details of its Q4 plans remain undisclosed.

Learn More: Sanctum Website

Follow Sanctum: Twitter

Marinade

Q3 Recap:

User Growth: Marinade reported a user base of over 74,000.

TVL: The platform's Total Value Locked reached $146.01M.

New Launch: Marinade Native launched in July, attracting 1.78M staked SOL within a month.

Q4 Forward Look:

Upcoming Incentives: Marinade has indicated that new incentives will be rolled out in Q4, although specific details have not been disclosed.

Marinade has seen substantial growth in Q3 with the expansion of its user base and a successful new offering. The platform is keeping details about its Q4 plans under wraps, but new incentives are on the horizon.

Stake on Marinade: Marinade Finance

Follow Marinade: Twitter

JitoSOL

Q3 Recap:

TVL Growth: The Total Value Locked (TVL) has seen a 100% increase, rising from 740k SOL to 1.62M SOL over Q3.

Referral Program: A new referral program was initiated to boost user engagement and adoption.

Q4 Forward Look:

Potential Developments: The platform is exploring the possibility of launching a new token and expanding its referral rewards system.

JitoSOL has made notable strides in Q3, particularly in TVL growth and user engagement through its new referral program. It is poised for potential innovations in Q4, keeping the community in anticipation.

Stake with Jito: Jito Network

Follow Jito: Twitter

SolBlaze

Q3 Recap:

Token Launch: SolBlaze successfully launched its new native token, $BLZE.

Market Cap: The initial Fully Diluted Market Cap (FDMC) stood at $2.8 million.

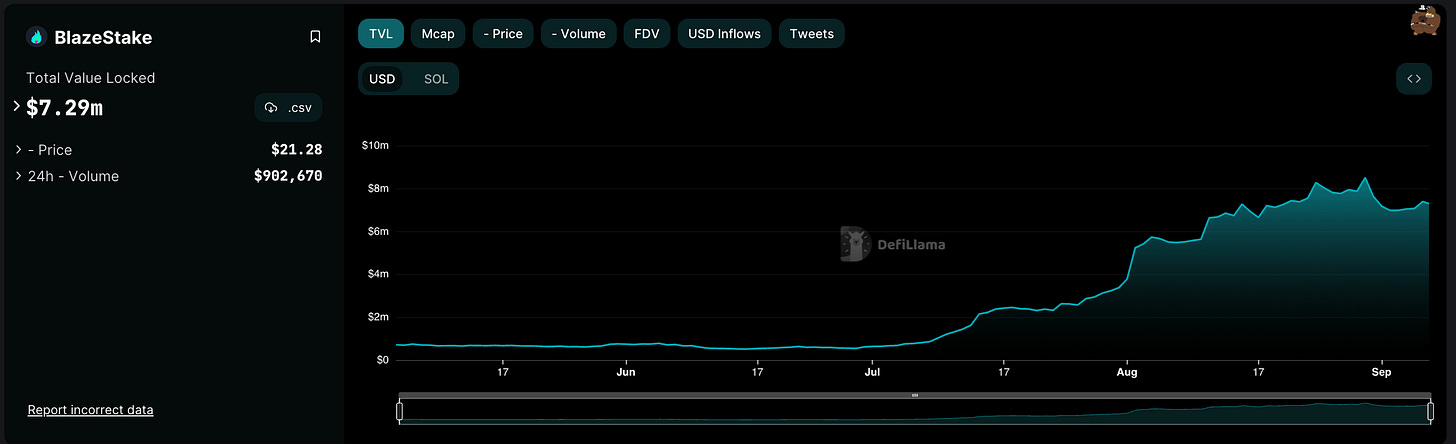

TVL Growth: The Total Value Locked (TVL) saw a significant 10x increase, going from $631k to $7.29M.

Airdrop: A unique SolBlaze Score metric was introduced, which is used to airdrop $BLZE tokens to users based on various factors like staking and referrals.

Q4 Forward Look:

Upcoming Features: The platform plans to roll out new features including BLZE Gauges for transparent and equitable reward distribution, and Bribes to incentivize staking.

SolBlaze made a splash in Q3 with the launch of its $BLZE token and rapid growth in TVL. As it moves into Q4, the focus will be on enhancing platform utility and user incentives with the introduction of new features.

Stake with SolBlaze: SolBlaze Staking

Follow SolBlaze: Twitter

Lending and Borrowing

The lending and borrowing sector has been a driving force in the ascent of Solana's Total Value Locked (TVL). Thanks to points systems and new incentives rolled out by the two largest lending and borrowing protocols on Solana, the TVL in this space has been climbing steadily. As we delve into the metrics, innovations, and upcoming features, it's clear that this sub-sector is setting the stage for Solana's DeFi ecosystem to flourish even further.

MarginFi

Q3 Recap:

TVL Surge: MarginFi experienced a remarkable 10x growth in its Total Value Locked (TVL), increasing from $2M in July to $23.82M currently.

Market Context: Out of $10B staked in Solana, only 3% is in LSTs

Q4 Forward Look:

Upcoming Features: The team has plans for launching a stableswap platform and their own stablecoin, $mUSD, in Q4.

Reward System: It remains unclear whether the points system introduced will translate into a native token or stablecoin rewards for the community.

MarginFi had a highly successful Q3, marked by rapid growth in TVL and integration with Solana's staking environment. In Q4, the platform aims to further diversify its offerings and maybe introduce a unique rewards system.

Use MarginFi: App

Follow MarginFi: Twitter

Solend

Q3 Recap:

TVL Growth: Solend saw a robust 50% increase in its Total Value Locked (TVL), climbing from $30.37M to $54.23M.

User Engagement: New features such as Margin and Points system were introduced. The Margin feature provides a trading view, while the Points system rewards users for activities like depositing and trading.

Q4 Forward Look:

Future Development: Plans for Q4 include more support for Liquidity Staking Tokens (LSTs) and the introduction of Real-World Asset (RWA) based pools.

Solend made significant strides in Q3, both in terms of TVL and user engagement features. Q4 aims to build on this momentum with new types of asset support and further financial tools, broadening the platform's utility and reach.

Use Solend: Website

Follow Solend: Twitter

Kamino Finance

Q3 Recap:

Trading Volume: Kamino Finance facilitated over $1 billion in trading volume.

Revenue: The protocol generated $1.25M in fees for its depositors.

User Tools: New features include Creator Vaults for user-generated market strategies and Comprehensive Analytics for tracking performance metrics.

Q4 Forward Look:

Next Version: Kamino 2.0 is slated for Q4, promising additional features to further expand its utility in the Solana DeFi ecosystem.

Kamino Finance has made significant strides in Q3, particularly in trading volume and user-generated tools. The anticipated Q4 release of Kamino 2.0 is expected to continue this trajectory, adding even more functionalities and features.

Use Kamino: Website

Follow Kamino: Twitter

Conclusion

In summary, Q4 for Solana's DeFi ecosystem is poised for significant growth, akin to progressing from the foundational stages of a skyscraper to outfitting its upper levels with sophisticated features. With a range of incentives on the horizon, plans for attracting liquidity from various quarters, and an improved user experience, Q4 projects a bullish outlook for Solana's DeFi landscape.